Colorado Startup Loan Fund

Open Request for Applications for Program Lenders

OEDIT is pleased to announce additional funding for the Colorado Startup Loan Fund (CSLF). We're actively seeking applications from all eligible Community Development Financial Institutions (CDFIs) and non-profit lenders, including existing partners and other lenders to expand loan opportunities for startup businesses. A Request for Applications (RFA) outlines the requirements for institutions to access CSLF loan capital along with funding for integrated and comprehensive technical assistance for Colorado small businesses.

Eligibility: Eligible applicants include CDFIs and non-profit lenders committed to serving Colorado entrepreneurs, particularly those who may struggle to obtain traditional financing. Specific criteria are detailed within the RFA document.

Application Process and Timeline

- Review the Request for Applications (Google Doc) for detailed instructions and submission requirements.

- RFA Questions & Answers Document: Access to the Q&A Document - Inquiries and OEDIT Responses (PDF) for frequently asked questions and OEDIT's official responses.

- CSLF Voluntary Application Information Meeting Recording: Watch the recording of the meeting held on Thursday, July 10th, for an overview of the program and application process: Link to Meeting Recording

- Application Published: June 27, 2025

- Intent to Apply Deadline: July 18, 2025

- Application Deadline: August 1, 2025

Program Summary

Please note, our webpage can be translated to Español, Tiếng Việt, 中文, Soomaali, العربية, አማርኛ, Français, and 126 other languages using the Google Translate™ tool on the top right of our webpage.

The Colorado Startup Loan Fund provides loan capital coupled with comprehensive Technical Assistance to mission-based lenders. These lenders, in turn, provide loans to Colorado entrepreneurs and small business owners needing capital to start, restart, or restructure a business, and those who are not able to obtain a loan from traditional lenders. This is a revolving loan fund, meaning the dollars will be used to continue supporting new entrepreneurs as loans are repaid.

OEDIT has partnered with mission-driven lenders to provide micro loans under $150,000 to small business owners and entrepreneurs with capital from the Colorado Startup Loan Fund. By offering smaller-than-average loans with favorable terms and interest rates, the program seeks to make financing a possibility for entrepreneurs who might not qualify for or require a larger loan. These lenders are selected for their abilities to work with business owners who are located in rural areas, may not be native English-speakers, have never carried a loan, lack the traditional assets required to secure financing, or have been previously unable to obtain a loan.

The fund focuses on:

- Loan opportunities for existing businesses that are unable to qualify for traditional financing.

- Loan opportunities for new businesses that are unable to qualify for traditional financing, particularly those within their first twenty-four months of operation.

- Loan opportunities for existing businesses that have experienced significant financial setbacks or other challenges hindering their ability to secure traditional capital.

- Increasing access to capital for underserved communities and those historically excluded from traditional financing.

We are partnering with mission driven non-profit lenders and Community Development Financial Institutions (CDFIs) to administer the program. The benefit of working with these mission-based lenders is that they:

- Often provide loans where traditional lender underwriting and loan size limitations prevent them from making loans.

- Often have more flexible repayment and debt restructuring options.

- Many provide technical assistance and deeper outreach to underserved communities than traditional lenders are mission driven, so their interest rates and fees are lower than those provided by credit cards or payroll lenders.

- Support the economic advancement of populations and businesses that have lacked access to more traditional sources of capital.

Overview

Type: Loans

For: Small businesses

Amount: Loans between $10,000-$150,000 dependent upon offerings of lender

Application period: Businesses to apply directly with lenders beginning in September 2022 and applications will be accepted on a rolling basis through March 2032

OEDIT division: Business Funding and Incentives

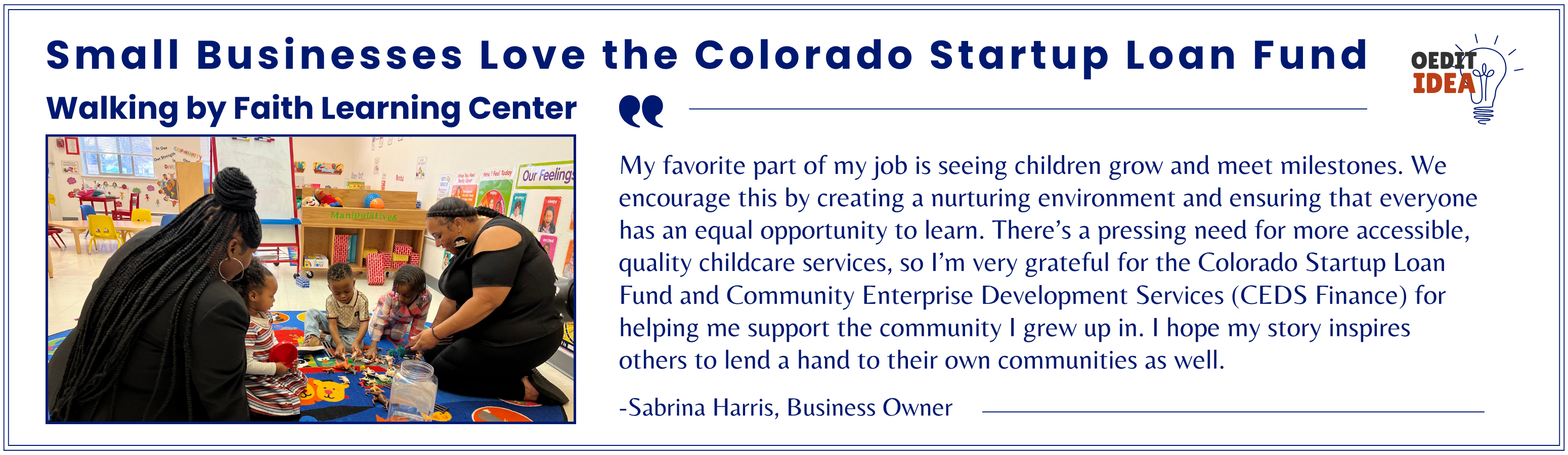

Image description: Business testimonial highlighting that small businesses love the Colorado Startup Loan Fund. Quote from Walking by Faith Learning Center Business Owner, Sabrina Harris, "My favorite part of my job is seeing children grow and meet milestones. We encourage this by creating a nurturing environment and ensuring that everyone has an equal opportunity to learn. There’s a pressing need for more accessible, quality childcare services, so I’m very grateful for the Colorado Startup Loan Fund and Community Enterprise Development Services (CEDS Finance) for helping me support the community I grew up in. I hope my story inspires others to lend a hand to their own communities as well."

Starting a new business

If you are looking for business assistance resources to prepare for applying for a small business loan we recommend that you work with the Small Business Development Center (SBDC) which provides small business workshops on starting and running a small business as well as free one-on-one consulting sessions. You can browse the list of available SBDC training workshops or locate the nearest SBDC.

Resources for existing businesses

The Small Business Navigator is a first point of contact for Colorado entrepreneurs and small-business owners needing support in their business journey. Fluent in English and Spanish, the navigator can also facilitate the use of an interpretation service for clients seeking assistance in the language of their preference.

Additional resources:

Applicants must meet all of the following criteria:

- For-profit entities located in Colorado with primary business activities in Colorado and who have a majority of employees working in Colorado.

- 25 or less Full-time equivalent (FTE) employees at the time the loan is made

- No more than $2 million in gross annual revenues in the preceding fiscal year and project no more than $2 million in gross annual revenues in the upcoming fiscal year.

- Unable to obtain traditional financing.

In addition, applicants must meet the credit requirements of the Colorado Startup Loan fund lender, which varies among lenders.

Examples of eligible loans:

- Loans under $150,000

- Repayment terms no greater than 10 years.

- Loans for startup working capital with cash flow projections that show future debt service coverage.

- Loans for working capital, startup expenses, tenant improvements, commercial real estate, equipment, and in some cases debt restructuring and business acquisitions.

If you have further questions please review the frequently asked questions section

Timeline

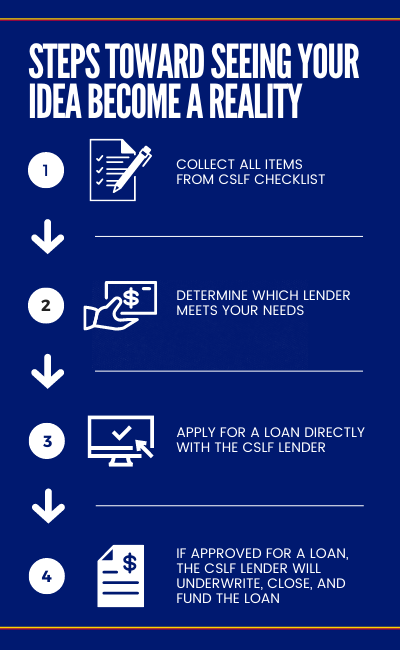

On average, this process takes 30-60 days from start to finish and can be optimized by having a complete application package prepared when applying with a lender. Lenders will offer Colorado Startup Loan Fund loans through 2032.

Colorado Startup Loan Fund (CSLF) Checklist

Businesses are encouraged to reference the Colorado Startup Loan Fund Checklist to gauge their preparedness for a small business loan and identify any areas where Technical Assistance may be needed.

This checklist outlines the information most business lenders typically require and is not intended to be a comprehensive list of application documents required for a loan from the Colorado Startup Loan Fund. Needs may vary depending on the size of the loan and the lender.

Download the Business Loan Preparedness Checklist, (PDF)

Descargue préstamos para Negocios - lista de requisitos generales, (PDF)

Tải về Danh sách kiểm tra Chuẩn bị Khoản vay cho Doanh nghiệp, (PDF)

Soo Dejiso liiska Hubinta u Diyaargarowga Amaahda Ganacsiga, (PDF)

, (PDF)قائمة التحقق من الاستعداد للحصول على قرض الأعمال التجارية

የንግድ ብድር ዝግጁነት ማረጋገጫ ዝርዝር, (PDF)

Télécharger la liste de préparation pour les entreprises pour un emprunt, (PDF)

What size loans are available?

Each lender will offer different loan sizes with minimum loan sizes of $10,000 and maximums of $150,000.

How do I decide which lender to work with?

Businesses are encouraged to determine which lender serves their geographic area and offers the type and size of loan they need.

How do I apply?

Businesses should identify the lender that serves their geography and business needs and apply directly with the lender to be matched with a loan funded by the Colorado Startup Loan Fund. Each lender will have their own application process and timeline. OEDIT will not be collecting applications.

How do I know if I am eligible for a loan?

Each lender will have unique eligibility requirements for the loans funded by the Colorado Startup Loan Fund. Additionally, some lenders will require that the business participate in their technical assistance programming to be eligible for a loan. Businesses are encouraged to refer to the minimum eligibility requirements of the program before connecting with a lender.

Is this a grant?

The Colorado Startup Loan Fund is not a grant program. This capital will be provided to mission based lenders to provide loans to small businesses. Some lenders may offer grants in association with a loan.

Where can I find grants that the Colorado Office of Economic Development and International Trade (OEDIT) offers?

To access open funding and programs please visit the Programs and Funding page on OEDIT’s website. Select all criteria that apply to what you are looking for. If you have further questions please contact the program’s manager assigned the program or funding.

Businesses should identify the lender that serves their geography and business needs and apply with the lender directly to be matched with a loan funded by the Colorado Startup Loan Fund. Each lender will have their own application process and timeline. OEDIT will not be collecting applications.

B:Side Fund

B:Side Fund is a mission-based, non-profit lender committed to helping small business owners succeed through support, funding, and resources. With funding from the Colorado Startup Loan Fund, B:Side Fund offers loan amounts ranging from $20,000 up to $150,000 and can be used to finance a variety of business purposes including working capital, debt refinance, business acquisition, inventory, equipment, furniture, and fixtures (excluding vehicles or trailers).

B:Side offers small business loans to businesses located throughout the State.

Community Enterprise Development Services (CEDS Finance)

CEDS Finance is a mission-driven, non-profit, Community Development Financial Institution that supports the American Dream of financial self-sufficiency by providing business financing to immigrants, refugees, and those from other underserved communities to start, grow, or strengthen their businesses. CEDS Finance provides microloans up to $100,000 to both startup and existing businesses throughout the seven Denver metro area counties (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Jefferson). CEDS Finance is also the only organization in the state of Colorado that provides Islamic-compliant business financing (murabahas), which offers financing up to $100,000 throughout the state of Colorado. In addition to business financing, CEDS Finance provides direct, tailored, one-on-one business technical assistance through our Business Consulting Officer. They also offer webinars, workshops, and referrals to other TA providers in the Denver metro area.

CEDS Finance offers small business loans to businesses located in Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, and Jefferson counties.

Work with Community Enterprise Development Services

Colorado Enterprise Fund (CEF)

Colorado Enterprise Fund (CEF) is a mission-driven, non-profit, Community Development Financial Institution small business lender committed to helping entrepreneurs start and grow their business. CEF has been dedicated to building businesses, driving community development, and creating jobs for over 45 years. CEF provides access to capital to low-income, minority, low- wealth, or underserved areas across Colorado. They support small businesses that don’t meet traditional financing guidelines for various reasons including the business is a startup, limited collateral, or lower credit scores. CEF provides flexible, low-barrier loans to be used for working capital, equipment,inventory, business purchase, property improvements, and more. CEF loans funded by the Colorado Startup Loan Fund range from $1,000 up to $150,000. CEF also provides free business coaching to small business borrowers through their Business Navigation Services. CEF “Navigators” help with areas such as business planning, marketing, sales, and accounting. CEF has been dedicated to building businesses, driving community development, and creating jobs for over 45 years.

CEF offers small business loans to businesses located throughout the State.

Work with Colorado Enterprise Fund

Exponential Impact (XI)

Exponential Impact (XI) is a non-profit organization with a mission to catalyze the entrepreneurial ecosystem in Southern Colorado. XI drives economic development through entrepreneurship by providing entrepreneurs access to capital, mentorship, educational

resources, and holistic training to build sustainable and resilient companies.

The Colorado Startup Loan Fund provides funding for XI’s Survive and Thrive program. XI’s Survive and Thrive program provides access to funding and capacity building to small businesses based in the Pikes Peak region to support the growth of the local economy. The Survive and Thrive program focuses on local businesses that are at a disadvantage in securing capital to stabilize or grow their businesses. The Survive and Thrive program seeks to provide support infrastructure to business owners to make necessary pivots and develop scaffolding for recovery and future resilience through low-barrier, low interest loans from $2,500 up to $100,000 paired with capacity building curriculum and community mentorship.

Completion of one of XI’s cohort-based educational programs is required before applying for a small business loan from XI. XI offers small business loans to businesses located in El Paso, Park, and Teller counties.

First Southwest Community Fund (FSWCF)

First Southwest Community Fund (FSWCF) is the non-profit partner of First Southwest Bank (FSWB), one of two Community Development Financial Institution (CDFI) banks in Colorado. FSWCF programs provide low-interest inclusive, accessible loans, grants and technical assistance to rural entrepreneurs and small businesses who are not able to access traditional financing.

With funding from the Colorado Startup Loan Fund Program, FSWCF operates The Innovate Onwards Fund which provides small grants and flexible working capital loans between $10,000 up to $150,000 to existing and new businesses across rural Colorado to build back rural economies.

FSWCF offers small business loans to businesses located in rural counties throughout the State.

Work with First Southwest Community Fund

Lendistry

Lendistry is a minority-led Community Development Financial Institution and an innovative small business lender that gives growing businesses a fair chance to access affordable capital. With the combined speed and convenience of technology, the knowledge and guidance of responsible lending, and the investment capital of social impactors and national banks, Lendistry is able to help business owners achieve their goals with flexible financing options.

Through the Colorado Startup Loan Fund Program, Lendistry offers loans to Colorado startups and small businesses to help them move forward and grow. Eligible for-profit entities can apply for $25,000 up to $150,000 in financing for working capital with terms of up to 10 years.

Lendistry offers small business loans to businesses located throughout the State.

Region 9 Economic Development District (Region 9)

Region 9 Economic Development District of Southwest Colorado, Inc. (Region 9) is a nonprofit, public private partnership that promotes and coordinates economic development efforts throughout southwest Colorado. Region 9 serves communities and businesses in Archuleta, Dolores, Montezuma, La Plata, and San Juan County through the management of a Business Loan Fund that promotes access to capital to rural underserved business owners. Region has partnered with 11 other Rural Business Loan Funds in the state to provide loans between $5,000 up to $150,000 for working capital, equipment, or real estate purchase down payment assistance with funds from the Colorado Startup Loan Fund.

Borrowers are encouraged to work with the Rural Business Loan Fund that serves their county to apply for a loan funded by the Colorado Startup Loan Fund from Region 9 Economic Development Group. Find your local rural business loan fund.

Region 9 and their Rural Business Loan Fund partners offer small business loans to businesses located in rural counties throughout the State.

Work with Region 9 Economic Development District

Rocky Mountain MicroFinance Institute (RMMFI)

RMMFI is a non-profit Community Development Financial Institution with a holistic model that combines capital access with education, mentorship, and community support to help both aspiring and experienced entrepreneurs build strong personal and business foundations. RMMFI serves entrepreneurs from low-income backgrounds across Colorado, with a focus on the Denver metro area and Northeast and Southeast Colorado. RMMFI offers four types of loans funded by the Colorado Startup Loan Fund ranging from $200 up to $75,000. RMMFI’s loans are character-based, meaning they look beyond financial information, and do not consider citizenship status or criminal background when making lending decisions.

Completion of one of RMMFI's cohort-based educational programs is required before accessing a small business loan from RMMFI. RMMFI offers programming and small business loans to businesses located in Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Jefferson.

In addition, RMMFI offers programming and small business loans to formerly incarcerated individuals in Baca, Bent, Crowley, Huerfano, Kiowa, Morgan, Otero, Phillips, Prowers, Sedgwick, Washington, Weld, Yuma counties.

Work with Rocky Mountain MicroFinance Institute

Northeastern Colorado Revolving Loan Fund

Northeastern Colorado Revolving Loan Fund is located in Yuma, Colorado. We have a defined market that consists of six counties. The counties cover over 9,900 square miles of rural, mostly agricultural land in the far northeastern corner of the state of Colorado.

Finance provided by NCRLF must be geographically located within these confines.

Counties Served: Logan, Morgan, Washington, Yum, Philips, Sedgwick

Work with Northeastern Colorado Revolving Loan Fund

Northwest Loan Fund

The Northwest Loan Fund makes business loans for start-ups, transitions, business acquisitions, business expansions, equipment, working capital, and owner-occupied real estate.

Counties Served: Eagle, Garfield, Grand, Jackson, Moffat, Pitkin, Rio Blanco, Routt, and Summit

Clear Creek Economic Development Corp.

Our mission: To catalyze a diverse and thriving business community that expands and stabilizes the workforce and tax base, and supports partnerships with passionate place makers.

Counties Served: Clear Creek, Gilpin

Work with Clear Creek Economic Development Corp.

Prairie Development Corporation

PDC is a non-profit economic development organization dedicated to promoting and serving communities and businesses in Cheyenne, Elbert, Lincoln and Kit Carson Counties -- a place we call Colorado's Central Plains.

When we talk to people about starting up their businesses or relocating their families to Colorado's Central Plains, the list of advantages is as long as a country mile. There seems to be no end to the open land. And there's a ready work force of strong, hard-working people. Plus, the location is prime with major highways, Denver and Colorado Springs just a stone's throw away.

Work with Prairie Development Corporation

Southeast Colorado Enterprise Development

Southeast Colorado Enterprise Development, Inc. (SECED) provides incentives and develops promotional activities that market and advertise the advantages of locating a business in the Southeast Colorado area. SECED employs multiple programs to create a positive identity, encourage retention and expansion of our existing businesses. We are committed to promoting redevelopment, attraction of new businesses, the expansion of the region's tourism industry and generally enhancing the economic growth of our member counties of Baca, Bent, Crowley, Kiowa, Otero and Prowers in Southeast Colorado.

Work with Southeast Colorado Enterprise Development

San Luis Valley Development Resource Group

The San Luis Valley Development Resources Group is known for our innovative approach to both economic and community self-development projects.

Our mission is to promote and facilitate economic development programs that create jobs, improve income, and maintain our quality of life in the San Luis Valley.

SLVDRG has served the six counties of the region – Alamosa, Conejos, Costilla, Mineral, Rio Grande and Saguache – since 1994. We are governed by a board of directors comprised of representatives from local government and the private sector.

Work with San Luis Valley Development Resource Group

Region 10 League for Economic Assistance & Planning

Region 10 leverages resources to help build strong communities. We do that by providing senior services, small business services, and regional development support to Delta, Montrose, Hinsdale, Gunnison, Ouray, and San Miguel counties.

Since 1972, Region 10 has operated as a 501(C)3 nonprofit that is supported by local and county governments. The organization’s programs are supported by several State and Federal programs and funding sources.

Work with Region 10 League for Economic Assistance & Planning

Business Loan Fund of Mesa County

The Business Incubator Center (BIC) is a 501(c)(3) non-profit organization that for more than a quarter century has been supporting the launch, growth, stabilization, and long-term success of business enterprises in Mesa County and the surrounding region. Our goal is to stimulate the local economy and retain/create the greatest number of sustainable jobs possible.

Contact